In recent years, the insurance industry has seen the emergence of a groundbreaking concept known as Peer-to-Peer (P2P) insurance. P2P insurance offers a community-driven alternative to the traditional insurance model, revolutionizing the way individuals share risks and provide financial protection. This innovative approach harnesses the power of technology and social connectivity to foster trust, transparency, and cost-effectiveness.

What is Peer-to-Peer(P2P) Insurance?

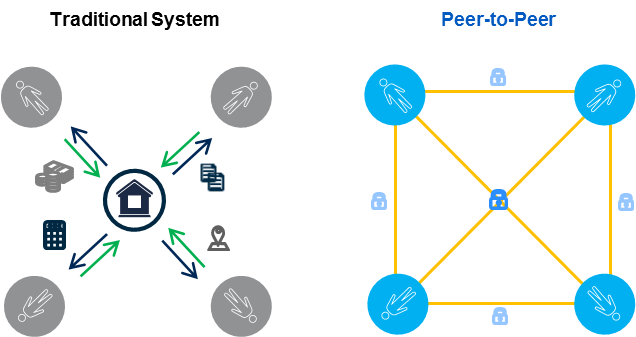

Peer-to-Peer (P2P) insurance is a revolutionary approach to risk-sharing that deviates from the traditional insurance model. In P2P insurance, individuals form a community or network and collectively pool their premiums to create a shared fund. This fund is used to cover potential claims and provide financial protection to members of the community. Unlike conventional insurance companies, P2P insurance platforms focus on transparency, trust, and community involvement, encouraging members to actively participate in risk management. The system leverages advanced technologies, such as blockchain and smart contracts, to streamline administrative processes and reduce overhead costs. Ultimately, P2P insurance fosters a more community-centric and equitable method of insurance, empowering individuals to have a direct stake in each other’s well-being and providing personalized coverage options.

In this article, we explore how P2P insurance differs from traditional insurance and why it is gaining momentum as a superior method of risk-sharing.

- Empowering Communities for Enhanced Trust

Traditional insurance companies often operate in a centralized manner, making decisions based on the interests of the company itself. In contrast, P2P insurance platforms bring policyholders together in a shared community where members have a vested interest in one another’s well-being. This community-centric approach fosters trust among participants, as they are more likely to act responsibly to protect the collective interests of their peers.

- Transparent and Fair Premiums

One of the key advantages of P2P insurance is the transparency of premium calculations. Traditional insurers often determine premiums based on complex algorithms and risk assessments, leaving policyholders questioning the fairness of the charges. P2P insurance platforms, on the other hand, rely on a transparent and collaborative approach, where members actively participate in determining the risk levels and, consequently, the premiums they pay.

- Eliminating Conflicts of Interest

Traditional insurers often face potential conflicts of interest when handling claims, as their profit margin could be affected by the number of claims paid out. In P2P insurance, community members share claims responsibility, minimizing conflicts and ensuring a more objective approach to claim settlements. With all members having a stake in the community’s success, the focus shifts from profit maximization to genuine risk-sharing and support.

- Reducing Administrative Overhead

P2P insurance platforms leverage advanced technology, such as blockchain and smart contracts, to streamline administrative processes. By automating various tasks like policy issuance, premium collection, and claims processing, P2P insurers significantly reduce administrative overhead costs. As a result, members can enjoy more competitive premiums and higher returns in the event of a surplus.

- Encouraging Proactive Risk Management

In traditional insurance, policyholders may be more inclined to adopt a passive approach, assuming that the insurer will cover any potential losses. However, P2P insurance emphasizes the importance of community involvement and proactive risk management. Members are encouraged to take preventive measures and promote responsible behavior, reducing the likelihood of claims and benefiting the entire community.

- Personalized Coverage Options

P2P insurance platforms allow for greater flexibility in coverage options. Since policies are collectively designed by the community, members can customize their plans according to their specific needs and preferences. This personalized approach ensures that policyholders have adequate coverage without paying for unnecessary extras, leading to more cost-effective and tailored protection.

Below is a comparison table highlighting the key differences between Peer-to-Peer (P2P) insurance and regular insurance:

| Aspect | P2P Insurance | Regular Insurance |

|---|---|---|

| Risk Pooling | Community-Centric | Centralized |

| Decision Making | Collaborative and Transparent | Company-Driven |

| Premium Determination | Transparent and Community-Driven | Complex Algorithms and Risk Assessments |

| Trust and Accountability | Community Empowerment | Company Accountability |

| Conflict of Interest | Minimized | Potential for Conflicts |

| Claim Settlement | Community Responsibility | Company Responsibility |

| Technology Adoption | Embraces Advanced Technology | Varies, Some Traditional Insurers Adopting |

| Administrative Overhead | Reduced with Automation and Blockchain | Higher with Manual Processes |

| Flexibility | Tailored Coverage Options | Standardized Plans |

| Incentivization | Incentives for Responsible Behavior | Profit-Driven Approach |

| Proactive Risk Management | Encouraged | Passive Approach |

| Personalization | Customizable Policies | Less Customization |

Explanation:

- Risk Pooling: P2P insurance pools risks within a community of members who collectively share financial burdens, while regular insurance operates in a centralized manner.

- Decision Making: P2P insurance involves collaborative decision-making with community involvement, whereas regular insurance decisions are made by the company.

- Premium Determination: P2P insurance relies on transparent community-driven premium calculations, whereas regular insurance uses complex algorithms and risk assessments.

- Trust and Accountability: P2P insurance fosters trust among community members, while regular insurance is accountable to its shareholders or stakeholders.

- Conflict of Interest: P2P insurance minimizes conflicts of interest, as the community shares claims responsibility, while regular insurance companies may be influenced by profit considerations.

- Claim Settlement: P2P insurance relies on the community for claim settlement, whereas regular insurance companies handle claim settlements.

- Technology Adoption: P2P insurance platforms leverage advanced technologies like blockchain, while regular insurers may vary in their adoption of new technologies.

- Administrative Overhead: P2P insurance reduces administrative costs through automation and blockchain, while regular insurers may have higher overhead due to manual processes.

- Flexibility: P2P insurance offers personalized coverage options, while regular insurance may have more standardized plans.

- Incentivization: P2P insurance incentivizes responsible behavior to benefit the community, while regular insurance companies are driven by profit motives.

- Proactive Risk Management: P2P insurance encourages community members to take proactive risk management measures, while regular insurance may have a more passive approach.

- Personalization: P2P insurance allows for greater customization of policies, while regular insurance policies may offer less flexibility.

In summary, P2P insurance offers a more community-centric, transparent, and personalized approach to risk-sharing, while regular insurance follows a traditional centralized model. The choice between the two depends on individual preferences, risk appetite, and the level of community involvement desired by the insured parties.

Frequently Asked Questions on Peer-to-Peer Insurance

- What is Peer-to-Peer (P2P) insurance, and how does it differ from traditional insurance?

- Answer: P2P insurance is a community-centric approach to risk-sharing where individuals pool their premiums to create a shared fund that covers potential claims. It differs from traditional insurance by emphasizing transparency, trust, and community involvement, as opposed to a centralized company-driven model.

- How are premiums determined in P2P insurance compared to regular insurance?

- Answer: In P2P insurance, premiums are determined collaboratively and transparently within the community, allowing members to actively participate in setting their premium levels. In contrast, regular insurance companies use complex algorithms and risk assessments to calculate premiums.

- What are the key advantages of P2P insurance over traditional insurance?

- Answer: P2P insurance offers several advantages, including enhanced trust within the community, reduced conflicts of interest, more personalized coverage options, proactive risk management encouragement, and streamlined administrative processes through advanced technology adoption.

- How does P2P insurance promote responsible behavior and risk management among its members?

- Answer: P2P insurance platforms incentivize responsible behavior by encouraging members to take proactive risk management measures. Since the community shares claims responsibility, there is a collective interest in minimizing claims, leading to a greater focus on preventive actions and risk reduction.

- Is P2P insurance suitable for everyone, or are there specific scenarios where it is more advantageous?

- Answer: P2P insurance can be advantageous for individuals who value community involvement, transparency, and customization in their insurance coverage. It may be particularly beneficial for those seeking a more equitable and community-driven alternative to traditional insurance, as well as for people interested in embracing advanced technologies to streamline insurance processes. However, the suitability of P2P insurance depends on individual preferences and risk profiles.