The traditional banking system, a cornerstone of modern finance, plays a pivotal role in the global economy by facilitating the movement of money, providing financial services, and supporting economic growth. Rooted in history and adapted over time, this system forms the bedrock of financial interactions for individuals, businesses, and governments. In this article, we will delve into the fundamental aspects of the traditional banking system, exploring its components, functions, and significance.

Components of the Traditional Banking System:

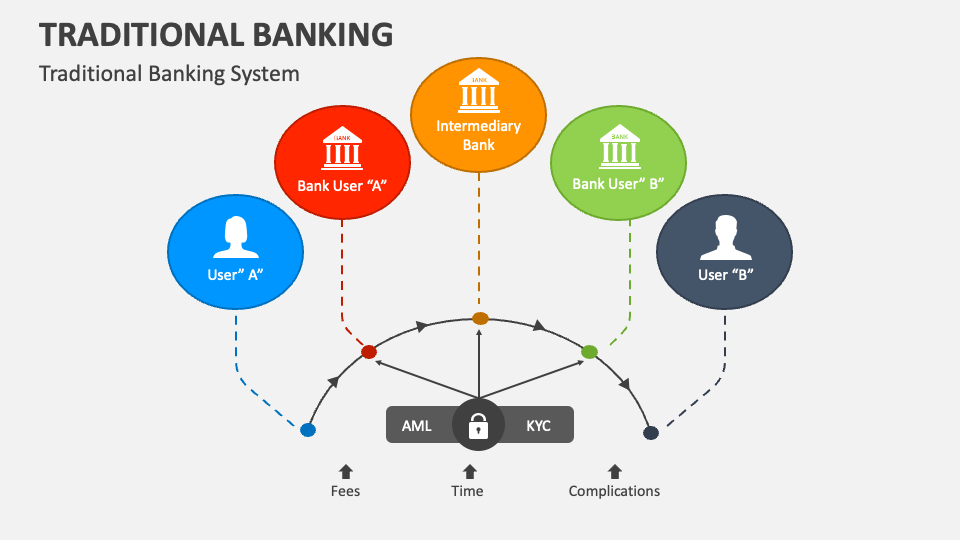

- Financial Institutions: At the heart of the traditional banking system are financial institutions, commonly known as banks. These institutions act as intermediaries between individuals, corporations, and the government, managing the flow of funds and providing various financial services.

- Customers: Customers of the banking system encompass a broad spectrum, ranging from individual savers and borrowers to small and large businesses, as well as governmental bodies. Each group has specific financial needs that the banking system addresses.

- Accounts and Transactions: Banking systems offer various types of accounts such as savings accounts, checking accounts, and certificates of deposit (CDs). These accounts serve as repositories for individuals’ funds and provide the basis for various transactions.

- Loans and Credit: Banks extend loans and credit to individuals and businesses to support various financial needs, such as buying homes, funding education, or expanding businesses. Interest rates charged on these loans constitute a significant source of revenue for banks.

- Payments and Settlements: Banks enable the efficient transfer of funds between accounts and individuals. They also facilitate transactions between buyers and sellers by providing payment systems like checks, wire transfers, and electronic funds transfers.

- Risk Management: Banks play a vital role in managing financial risks. They assess the creditworthiness of borrowers, perform due diligence, and establish risk mitigation strategies to ensure the safety of deposited funds and the stability of the financial system.

Functions of the Traditional Banking System:

- Intermediation: One of the primary functions of the traditional banking system is financial intermediation. Banks gather funds from depositors and lend them to borrowers, effectively channeling money from those who have excess funds to those who need capital for various purposes.

- Payment System: Banks provide a reliable and secure platform for transferring money between individuals and entities. This function supports everyday transactions, such as paying bills, making purchases, and transferring funds across borders.

- Savings and Investment: By offering various types of accounts, banks encourage individuals and businesses to save and invest. Savings accounts provide a safe place to store funds, and investment options like CDs offer opportunities for higher returns.

- Credit Provision: The traditional banking system plays a crucial role in granting credit to individuals and businesses. This credit supports economic growth by funding projects, expansion, and innovation that might otherwise be hindered by lack of funds.

- Financial Advice: Many banks offer financial advisory services to help customers manage their money, make informed investment decisions, and plan for their financial future.

Significance of the Traditional Banking System:

The traditional banking system’s significance lies in its ability to foster economic growth, promote financial stability, and provide essential financial services. It serves as a cornerstone for various economic activities by efficiently allocating capital and facilitating transactions. Additionally, the system helps individuals and businesses achieve their financial goals, whether it’s buying a home, starting a business, or saving for retirement.

Despite the emergence of digital alternatives and fintech innovations, the traditional banking system’s enduring role is a testament to its historical importance and adaptability. As technology continues to reshape the financial landscape, the traditional banking system evolves to incorporate digital banking, online transactions, and enhanced customer experiences, ensuring its relevance in the modern world.

let’s compare Next-Generation Banking with Traditional Banking using a comparison table to highlight the key differences between the two:

| Aspect | Traditional Banking | Next-Generation Banking |

|---|---|---|

| Customer Interaction | Primarily in-branch or over the phone. | Multi-channel: Online, mobile apps, chatbots, AI. |

| Access to Services | Limited by branch hours and physical locations. | 24/7 access to services and transactions. |

| Account Management | Paper-based account opening and transactions. | Digital account opening and real-time updates. |

| Technology Adoption | Slow to adopt new technologies due to legacy systems. | Rapid adoption of fintech, AI, blockchain, etc. |

| Transaction Speed | Transactions may take time to process and clear. | Real-time transactions and instant payments. |

| Customization | Limited customization of services and products. | Highly personalized offerings and solutions. |

| Customer Insights | Limited data utilization for tailored services. | Data-driven insights for personalized experiences. |

| Financial Services | Mainly banking services with limited integration. | Ecosystem approach with various financial services. |

| Innovation | Innovation occurs but at a slower pace. | Constant innovation, driven by fintech partnerships. |

| Security | Relies on traditional security methods. | Advanced security through biometrics, AI, and blockchain. |

| Physical Presence | Requires physical presence for many transactions. | Many services can be done remotely, reducing branch visits. |

| Customer-Centricity | Focus on customer needs but often falls short. | Strong focus on customer experience and preferences. |

| Regulatory Compliance | Complies with traditional banking regulations. | Navigates new regulatory challenges of technology. |

It’s important to note that these comparisons provide a general overview and that both traditional and next-generation banking systems have their advantages and challenges. The shift toward next-generation banking is driven by the increasing demand for convenience, speed, and personalization, enabled by emerging technologies. However, traditional banking still serves an essential role, particularly for customers who prefer face-to-face interactions and are more comfortable with established practices. The banking landscape is evolving, and a combination of both traditional and next-generation approaches is likely to persist to cater to diverse customer preferences and needs.